Alumni of Harvard who number among the ranks of pro players include Andy Bloch and Richard Brodie. Full Tilt Pro Brandon Adams is also an economics instructor at Harvard. 2009-2010 Tuition and Fees: $33,696; Bonus Points: If you can afford to go to Harvard you can probably afford to lose some money learning to be a good poker player. Then, out of nowhere, bam, there’s high stakes poker player and Harvard economics instructor Brandon Adams. In an interview with Katie Couric, Adams, who started taking Adderall in college, discusses who the drug’s use is common in professors as welland that he recently took it to help him finish write a book. He also cops to using Provigil.

http://www.bloomberg.com/avp/avp.htm?N=video&T=Poker%20Champ%20Cada%20Hopes%20to%20Transition%20to%20Stock%20Market%20&clipSRC=mms://media2.bloomberg.com/cache/vylFZx4IgreY.asfhttp://www.bloomberg.com/avp/avp.htm?N=video&T=Steve%20Begleiter%20Interview%20on%20Wall%20Street%2C%20Poker%20&clipSRC=mms://media2.bloomberg.com/cache/vPJU3JAP7uS4.asf

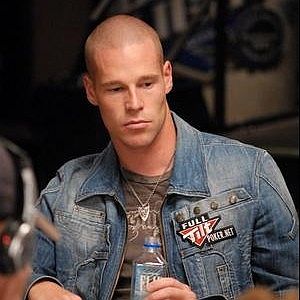

Brandon Adams Poker Harvard Game

Brandon Adams, who teaches behavioral finance at Harvard University’s Department of Economics, says some of the best candidates for Wall Street trading jobs are the professional card players at FullTiltPoker.com and similar Web sites. “They’ve essentially been the survivors in the system, a very difficult system where 95 percent of people lose money,” the 30-year-old Adams, who plays at the site, said in a telephone interview. “Anyone smart enough and disciplined enough to survive that system is probably going to do very well in the trading world.”

“They’ve essentially been the survivors in the system, a very difficult system where 95 percent of people lose money,” the 30-year-old Adams, who plays at the site, said in a telephone interview. “Anyone smart enough and disciplined enough to survive that system is probably going to do very well in the trading world.”An increasing number of hedge funds and brokerages are scrutinizing professional poker to find talent and analytical tools, according to financial recruiters including Options Group, a New York-based executive-search company. Susquehanna International Group LLP, the Bala Cynwyd, Pennsylvania-based options and equity trading company, uses poker to teach strategic thinking.

“Someone who has made a successful living as a poker player for a few years would more likely be a good trader than someone who hasn’t,” said Aaron Brown, a 53-year-old former poker pro who is now a risk manager at AQR Capital Management LLC in Greenwich, Connecticut, which oversees $23 billion. “They know to push when they have the edge and they know how not to bust, and that’s a tough combination to find.”

Skill Sets

Brandon Adams Poker Harvard Ranking

Skills that define successful traders -- rational approach toward risk, speedy decision-making under pressure, discipline and a well-trained memory -- are the same ones that separate elite poker players from ones known as “dead money,” financial recruiters say.After the World Series of Poker started in Las Vegas four months ago, Options Group recruiter Simon Satanovsky said he received a hedge-fund request for online poker players with no financial experience. He wouldn’t identify the client.

“Before, we were asking about GPA or the Math/Physics Olympiad,” Satanovsky, a former Russian national bridge champion, said in a telephone interview. “Now, we’re asking questions about poker successes.”

Satanovsky said Wall Street firms and recruiters have been paying increasing attention to poker players as job candidates since 2003, when amateur Chris Moneymaker beat hundreds of professionals to win the World Series of Poker’s No-Limit Texas Hold ‘Em main event.

The Right Game

Adams, who has taught at Harvard in Cambridge, Massachusetts, each spring since 2003, said disciplined poker players can be spotted on sites such as Full Tilt and PokerStars.com waiting for particular games, not tempted by those outside their area of expertise or financial comfort level.

Their self-control and confidence would be useful in trading where large profits are possible, the probability of going broke high and the competition formidable, he said. Adams cited as an example a trader who notices a slight imperfection in the way options are being priced, then works to come up with the proper bet per trade.

“In poker, people are used to not sitting back and waiting for the fat pitch,” Adams said. “They’re used to skirting the edge of ruin and they learn the tools of how to do that.”

Susquehanna has been using poker to teach its new traders since it was founded in 1987, said Pat McCauley, who heads the privately held firm’s trader-development program.

College Friends

The company’s founders played the game as college friends at the State University of New York-Binghamton. Susquehanna has held in-house poker tournaments to recruit traders and monitor decision-making skills.

The trainees learn to use information they see in the marketplace to infer what motivates others, helping them make better prices. It’s the same way poker pro Phil Ivey, considered among the game’s greats, makes bets based on what he sees among his opponents, McCauley said.

“What professional poker players are really good at is taking this information that’s relatively subjective, quantifying it and making it objective, and that’s what trading is about,” McCauley said.

Brandon Adams Poker Harvard Invitational

The ability to write complex poker algorithms, which either run poker Web sites or try to beat them, will get hedge funds interested, said Todd Fahey, a recruiter who specializes in quantitative finance at New York-based Exemplar Partners.“There have been a few guys that I’ve placed in the industry that come from the poker software side of the house,” Fahey said in a telephone interview. “Two Sigma, D.E. Shaw and any of your larger computationally-based hedge funds are going to want to see people like this.”

Two Sigma Investments LLC and D.E. Shaw Group, both based in New York, declined to comment.

Begleiter’s Try

The worlds of poker and finance often intersect. Steven Begleiter, who headed corporate strategy at Bear Stearns Cos. before its 2008 collapse, earned $1.6 million earlier this month with a sixth-place finish in the main event. Greenlight Capital LLC founder David Einhorn was 18th in 2006. The annual “Wall Street Poker Night,” benefiting Math for America, was started by billionaire James Simons, the founder of hedge-fund firm Renaissance Technologies Corp. This April, the $5,000 buy-in tournament drew 100 entrants -- 90 percent from hedge funds or other Wall Street jobs -- raising $1.3 million.

Even though poker players make good traders, they aren’t necessarily good with their own investments, said Adams, adding that he is almost “famously unsuccessful” as an investor.

Even though poker players make good traders, they aren’t necessarily good with their own investments, said Adams, adding that he is almost “famously unsuccessful” as an investor.“Poker players are lazy and they’re gossipers,” he said. “If you look at the way they trade, they tend to latch onto other people’s ideas.”

Texas Hold ‘Em

One person who has chosen poker over finance is Joe Cada, who this month outlasted Begleiter and Ivey at the main event final table. Cada, who plays the game professionally, was first among 6,494 entrants and took home the $8.55 million top prize, giving half to financial backers Cliff Josephy and Eric Haber, poker pros with Wall Street backgrounds. The Texas Hold ‘Em contest had a $10,000 entry fee.

“As a little kid, I used to watch the stock markets day in and day out,” Cada, 22, said in an interview. “My parents always thought I was going to get into banking or become a stockbroker because I was really good with math and logic, and I was obsessed with money.”

Cada said he plans to remain a poker pro. AQR’s Brown, the author of “The Poker Face of Wall Street” and a life-long player, long ago gave up the game professionally after a couple years of trying.

Cada said he plans to remain a poker pro. AQR’s Brown, the author of “The Poker Face of Wall Street” and a life-long player, long ago gave up the game professionally after a couple years of trying.“I eventually decided finance was easier,” he said.

Coaching has been a norm in the poker industry for the past few years, largely because of the growth of the online poker-playing community. However, coaching in other industries including finance, publishing, and business has not been the norm. The term, “time is money” has been given a whole new meaning by the website Expert Insight which was founded by high stakes cash game player Brandon Adams, and the whole premise of the business is to offer up hourly coaching by experts in a variety of trades.

For $400 an hour, Jeff Miron, a senior lecturer on economics from Harvard will be at your service to inform you of the latest policy conflicts worldwide. Or, for an unpublished fee, you can discuss marketing secrets with Daymond John, CEO and founder of FUBU. As for poker, you can pick the brains of some of the most accomplished players in the world. Patrik Antonius charges $6,000 an hour, while Tom Dwan's price is a bit steeper at $6,500 an hour. The unique website is quickly gaining interest. PokerNews spoke with Adams about Expert Insight.

When and how did you come up with the idea for the site?

I came up with the idea for the site in April 2010. I was doing some one-to-one coaching myself, and it struck me that the way these calls were set-up was pretty primitive. I envisioned a web platform such that every aspect of an expert call - the scheduling of the call, the payment for the call, and the actual audio-video conference itself - could be handled on a single site.

The benefits to the expert would be assured payment, minimal back-and-forth time in scheduling calls, and privacy (no need to give out email/phone/Skype info, as everything is done within site).

Expert Insight is always looking for more 'experts.' What is the application and approval process like?

Many of our experts are actively recruited by the Expert Insight team. But it is possible for anyone to go to www.expertinsight.com and create an expert profile. Every couple of days, we look at the new expert profiles that have been created and we decide which ones we'd like to add to the site.

For someone who is an expert on your site, how is his or her price calculated?

The experts choose their own schedule and price. Most experts choose a price that is too high. I am always encouraging my experts to lower their price. I think everyone would be happier if all prices were halved. The users would find more value in the site, and the experts would do a lot more business.

If I were to book you for an hour, in general, what could I expect from our appointment?

I do a lot of calls. At first, about half the calls were related to poker and half were related to economics. Now I'd say 80 percent of my calls relate to economics or finance. The market for poker calls is largely dead.

I've taught economics and finance via Skype to a lot of top poker players like Tom Dwan, Brian Hastings, Ben Sulsky, Chris Sparks, and many others. The word has spread that I'm good at that, and that is a lot of my business now. Usually the first lesson is exploratory. We talk about a little of everything, and I gauge their area of interest. At the end of the first session and every subsequent session, I'll usually recommend a book that we'll use that book to frame our next conversation.

For those who have booked an appointment with an expert, what advice could you give them to get the most out of their experience?

An hour can go by quickly. It's a good idea to have a list of four or five items for discussion. The user should feel free to move the expert along to the next item when he's ready.

Is there anything else you want readers of this article to know about Expert Insight?

On the poker side, I'm shocked that we don't do more calls. I feel like we have the best poker coaches in the world, by far. It's stunning. Our site includes Tom Dwan, Patrik Antonius, Matt Hawrilenko, Ben Sulsky, Cole South, Brian Hastings. The most under-priced poker coach on our site, in terms of value provided, is probably Phil Newall, author of The Intelligent Poker Player. Patrik and Tom are overpriced, but users can shoot us an email through the site, and if we are not busy we will relay bids to Patrik or Tom that are lower than the ask price.

Remember, follow us on Twitter for up-to-the-minute news.

Tags

Brandon AdamsHigh Stakes PokerPatrik AntoniusPoker BusinessTom DwanRelated Players

Tom DwanPatrik AntoniusBrandon Adams